Shares of Plug Power Inc (NASDAQ:PLUG) are trading higher Friday afternoon following Federal Reserve Chair Jerome Powell's dovish Jackson Hole remarks, as investors reposition toward growth equities amid rising odds of interest rate cuts.

What To Know: Powell warned that "downside risks to employment are rising" and emphasized the Fed's willingness to adjust monetary policy should job losses accelerate. Markets interpreted the shift as a signal that rate cuts could arrive as early as the fall, a development with outsized implications for growth companies like Plug Power.

Growth stocks, particularly in clean energy manufacturing, are highly sensitive to interest rates. Plug relies heavily on future earnings streams and aggressive capital investment to fund expansion.

Read Also: Plug Power Beats Revenue Estimates, But JPMorgan Flags Cash Burn, Margin Uncertainty

Lower rates reduce borrowing costs for scaling manufacturing, while also increasing the present value of long-term cash flows, making the company's growth story more attractive to investors.

What Else: For Plug Power specifically, rate relief could ease financing costs tied to building hydrogen production plants, fuel cell systems and electrolyzer deployments. At a time when consumer demand is volatile and capital markets remain selective, cheaper credit provides a critical tailwind to sustaining Plug's ambitious growth roadmap.

Moreover, dovish Fed commentary has historically triggered sector-wide rallies in renewable energy equities, as investors rotate into long-duration assets with high growth potential. If Powell's caution translates into a rate-cutting cycle, Plug Power may emerge as one of the beneficiaries.

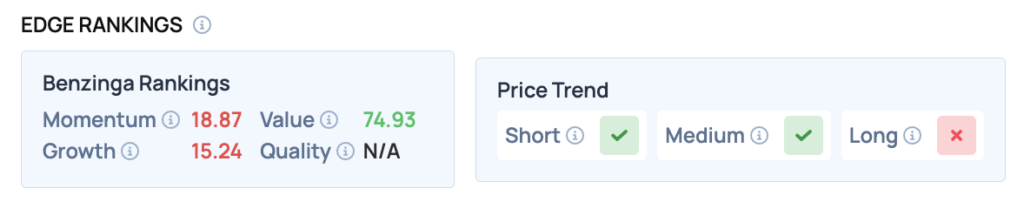

Price Action: According to data from Benzinga Pro, PLUG shares are trading higher by 5.88% to $1.63 Friday afternoon. The stock has a 52-week high of $3.32 and a 52-week low of $0.69.

Read Also: Plug Power Stock Sinks After Q2 Mixed Results: Details

How To Buy PLUG Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Plug Power’s case, it is in the Industrials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock