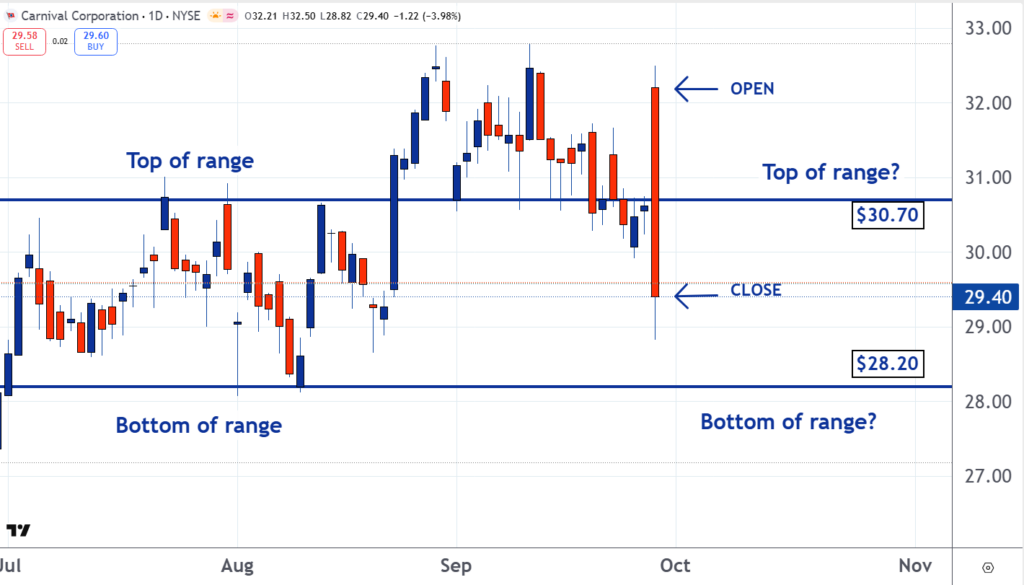

Shares of Carnival Corp (NYSE:CCL) are consolidating Tuesday. This follows yesterday's sell-off of almost 4%. The move came after the company released earnings.

Carnival is the Stock of the Day. It dropped back into a former trading range, and it looks like it may stay in it for a while.

From early July through late August, the top of the range was around $30.70. There was resistance there.

The bottom of the range was around $28.20. This was a support level.

The top of a trading range is resistance. This is a price or level where there is a large number of shares for sale.

Find out what CCL stock is doing here.

Read Also: Airlines Warn Government Shutdown Would Disrupt Flight Operations: ‘Congress Must Work Quickly…’

Resistance can stay intact for an extended time because some of the people who bought at the top of the range regret doing so when the shares drop after. Some decide that if the stock returns to their buy price, they will sell so they can exit the position at breakeven.

This selling at the level can keep the resistance intact.

The lower part of the range is support. This is a price or level with a large number of shares to be bought.

Support can remain intact for an extended time due to seller remorse. A number of the people who sold shares at the support came to regret doing so when the stock rallied. Some decided to buy their shares back if the shares drop back to their selling price.

This buying can keep support at the level.

Yesterday, Carnival fell back into this range. There is a good chance that it will stay in it in the short-term.

Some traders trade ranges by buying close to the bottom and selling close to the top. Other traders wait for the shares to either break out of the top of the range or break the bottom of the range before taking a position.

Over the next few weeks, these may each prove to be profitable strategies.

Read Next:

• Trump Administration Tightens Export Controls To Slow China’s Tech Race--Experts Hail ‘Massive Change’

Photo: Shutterstock