Rivian Automotive Inc (NASDAQ:RIVN) shares are trading lower Thursday afternoon, caught in a broader market downdraft as major indexes fall. Shares are also pulling back from strong gains on Wednesday following the company’s third-quarter results. Here’s what investors need to know.

- RIVN is encountering selling pressure. See what is driving the move here.

What To Know: Thursday’s negative sentiment was fueled by remarks from Chicago Fed President Austan Goolsbee, who expressed uncertainty about further interest rate cuts, citing a lack of recent inflation data due to the prolonged government shutdown.

The move reverses gains from Wednesday when Rivian shares surged following strong third-quarter results. The EV maker beat revenue expectations, posting $1.56 billion, and reported its first-ever consolidated gross profit of $24 million.

Rivian also recently announced it is spinning off its new industrial AI and robotics unit, Mind Robotics, after securing $110 million in external seed capital. Rivian will retain a 40.6% minority interest.

Additionally, on Wednesday, Goldman Sachs maintained its Neutral rating on the stock, but lowered its price target from $15 to $13.

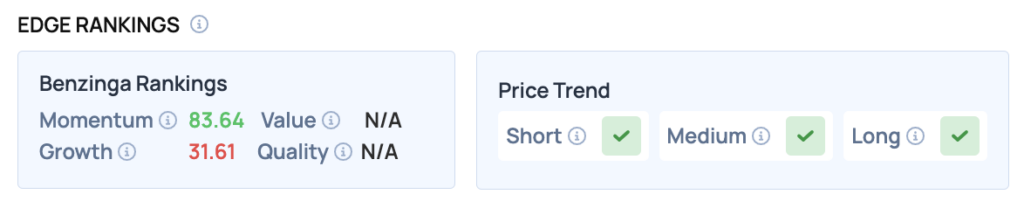

Benzinga Edge Rankings: According to Benzinga Edge Rankings, Rivian shows strong Momentum with a score of 83.64, though its Growth score lags at 31.61.

RIVN Price Action: Rivian Automotive shares were down 1.65% at $15.17 at the time of publication on Thursday, according to Benzinga Pro data.

Read Also: Supreme Court May Sink Trump’s Tariffs--But Don’t Expect Them To Disappear

How To Buy RIVN Stock

By now you're likely curious about how to participate in the market for Rivian Automotive – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock