Macy's Inc. (NYSE:M) is set to report its Q3 earnings on December 3, and the timing couldn't be more interesting. The stock is currently navigating a bullish Cakra breakout within its Adhishthana cycle on the weekly chart. With earnings approaching, it's important to evaluate where Macy's stands in its broader cycle and what the coming sessions may bring.

Understanding Macy's Bullish Cakra Breakout

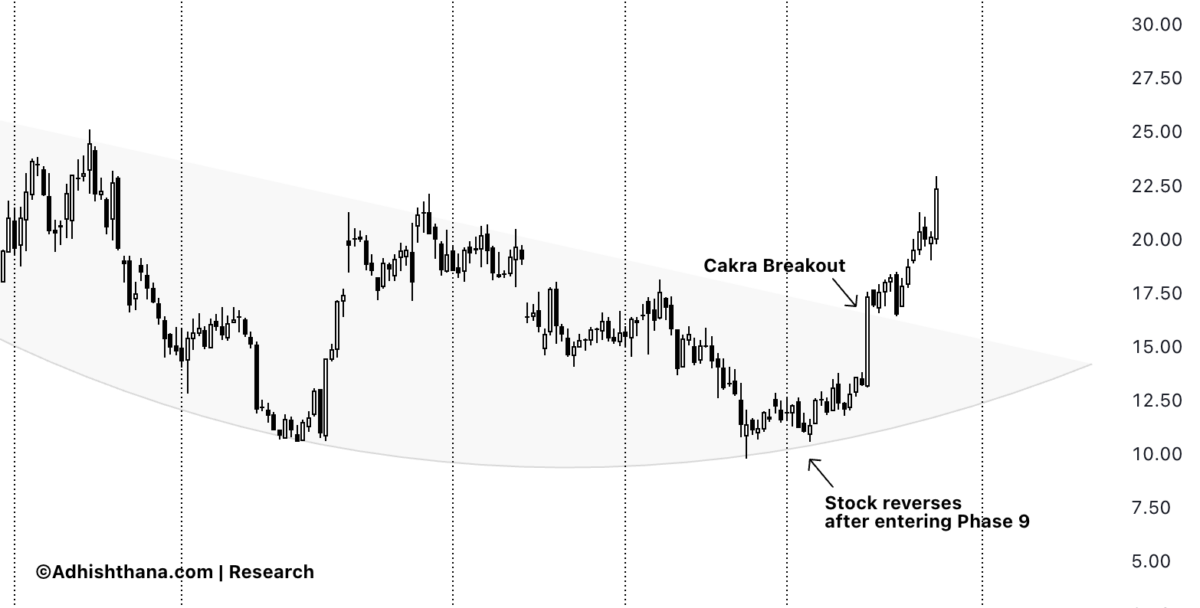

Under the Adhishthana Principles, stocks typically develop a Cakra structure between Phases 4 and 8. This structure, often resembling an arc, acts as a long-term consolidation zone with inherently bullish implications. Once a stock breaks this structure in Phase 9, it triggers the Himalayan Formation, a three-legged bullish sequence composed of an ascent, a peak, and a descent.

Macy's entered Phase 4 in January 2022 and remained inside its Cakra throughout Phases 4-8. True to the framework, the stock reversed from the lower arc in Phase 9 and broke out decisively, initiating a strong Himalayan ascent. Since the breakout, Macy's has rallied approximately 38%, and in Phase 9 alone, the stock is already up more than 116%, a classic signature of Phase 9's supreme move.

Now, Phase 9 for the stock continues until January 20, 2026, after which it will enter Phase 10, a phase where peak-formation probabilities start to rise.

As I wrote in Adhishthana: The Principles That Govern Wealth, Time & Tragedy:

"The 18th interval is expected to be the level of peak formation; if not, then the 23rd interval. If this phase concludes without forming the peak, it is anticipated to occur in the following phases."

This means that once Macy's transitions into Phase 10, the stock will begin approaching the window where its structural peak could materialize.

What's Ahead?

With strong Phase 9 momentum already realized and Q3 earnings approaching, volatility is expected, but not necessarily in a negative way. Earnings-driven profit-booking may occur, but that would not inherently alter the bullish structure in play.

The critical context is this:

- Macy's has already broken out of its Cakra

- It remains firmly within the ascent leg of the Himalayan Formation

- Phase 9 still has more time to unfold

- Phase 10 may introduce the first signs of the eventual peak

Structurally, the stock still carries bullish undertones, and its broader trajectory remains intact despite any short-term fluctuations.

Investor Outlook

Investors already holding Macy's have strong justification to continue doing so. While earnings could bring heightened volatility, the breakout from the Cakra pattern supports a sustained bullish stance. The bottom line is that Macy's is still in the upward leg of its long-term formation. Any near-term dips are more likely to be structural pauses than trend reversals.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.